CULLEN/FROST BANKERS (CFR)·Q4 2025 Earnings Summary

Cullen/Frost Q4 2025 Earnings: Beat on EPS and Revenue, $300M Buyback Authorized

January 29, 2026 · by Fintool AI Agent

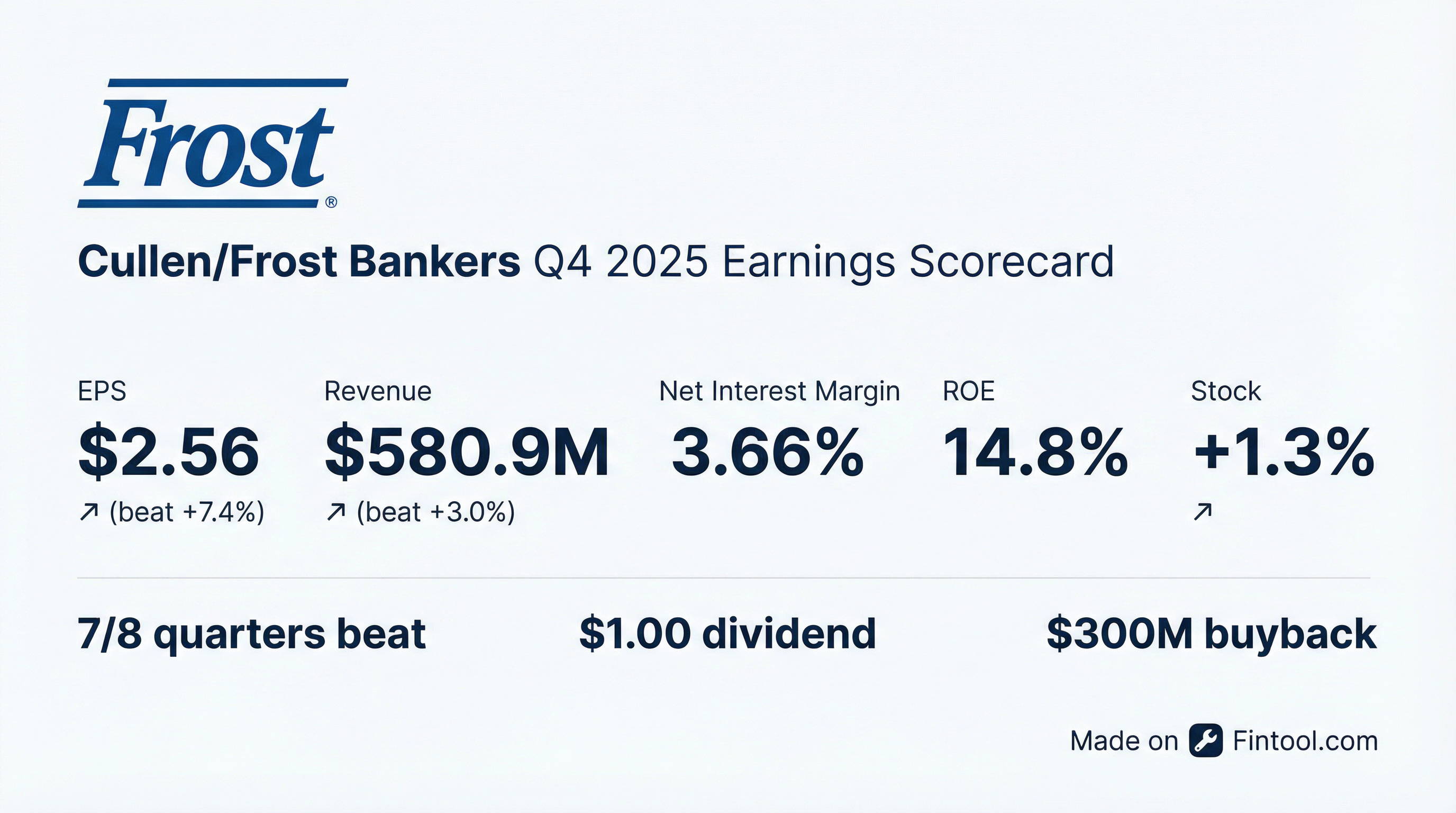

Cullen/Frost Bankers (NYSE: CFR) delivered a solid Q4 2025, beating consensus estimates on both EPS and revenue while the board authorized a new $300 million share repurchase program. The Texas-focused regional bank reported net income available to common shareholders of $164.6 million, up 7.4% year-over-year, driven by loan growth and net interest income expansion.

Did Cullen/Frost Beat Earnings?

Yes. CFR beat on both top and bottom lines:

This marks the 7th beat in the last 8 quarters for Cullen/Frost, with the only miss being Q2 2024.

Full-year 2025 EPS came in at $9.92, up 11.8% from $8.87 in 2024.

What Drove the Beat?

Net Interest Income Expansion

Net interest income on a taxable-equivalent basis increased 8.6% year-over-year to $471.2 million, the primary driver of the earnings beat.

Key factors:

- Average loans grew 6.5% YoY to $21.7 billion

- Average deposits increased 3.5% YoY to $43.3 billion

- Net interest margin expanded 13 bps to 3.66% from 3.53% in Q4 2024

Non-Interest Income Growth

Non-interest income rose 7.6% YoY to $132.2 million, driven by:

- Service charges on deposit accounts: +15.9% (+$4.5M)

- Trust and investment management fees: +4.3% (+$1.9M)

- Derivatives trading income: +$1.4M

What Changed From Last Quarter?

The slight NIM compression (-3 bps sequentially) reflects lower yields on earning assets as rates declined, though the bank's asset-sensitive balance sheet continues to benefit from the elevated rate environment.

Non-accrual loans increased to $70.5 million from $44.8 million in Q3, though this remains well below the $78.9 million level seen at year-end 2024.

Credit Quality Remains Strong

Credit metrics improved year-over-year despite the sequential uptick in non-accruals. Net charge-offs of $5.8 million (0.11% annualized) were less than half the Q4 2024 level.

Capital Return: $300M Buyback + Dividend Increase

The board announced a new $300 million share repurchase program expiring January 27, 2027, doubling the previous $150 million authorization.

In Q4 2025, the company repurchased 653,913 shares at $80.7 million, completing the 2025 program. For full-year 2025, CFR bought back 1.20 million shares at an average price of $124.67.

Dividend: $1.00 per share quarterly dividend declared, payable March 13, 2026. This represents a 5.3% increase from the $0.95 dividend paid in Q4 2024.

How Did the Stock React?

CFR shares rose +1.3% following the earnings release, trading at $136.34. The stock has gained 36% over the past 12 months, outperforming the KBW Regional Bank Index.

Organic Expansion Continues

CEO Phil Green highlighted the company's organic growth strategy:

"We carry great momentum with us as we enter 2026 and continue executing on a number of strategic growth initiatives. Frost bankers throughout the state remain squarely focused on making our customers' lives better and supporting their growth in an increasing range of ways over time."

During Q4, CFR opened new financial centers in Austin, Dallas, and San Antonio, bringing the 2025 total to 10 new locations.

One-Time Items to Note

Q4 results included several non-recurring items totaling a net $7.7 million expense:

Capital Position

All capital ratios improved year-over-year and remain well above regulatory minimums.

Key Risks & Watch Items

-

NIM Compression Risk: Net interest margin ticked down 3 bps sequentially and could face further pressure if rates decline faster than expected

-

Credit Normalization: Non-accrual loans increased 57% sequentially; while still low by historical standards, any deterioration in Texas commercial real estate bears monitoring

-

Expense Growth: Non-interest expense rose 10.6% YoY to $371.7 million, outpacing revenue growth of 7.6%

-

Tariff Uncertainty: Management flagged potential impacts from trade policy uncertainty on borrowers and economic conditions

Forward Catalysts

- Q1 2026 Earnings: Expected late April 2026

- New Branch Openings: Continued expansion in Texas markets

- Share Repurchases: $300M authorization provides buyback capacity

- Federal Reserve Policy: Rate trajectory will impact NIM and deposit costs

Summary

Cullen/Frost delivered another solid quarter, beating consensus on EPS (+7.4%) and revenue (+3.0%) while maintaining strong credit quality and capital ratios. The new $300M buyback authorization and dividend increase signal management confidence. While NIM faces some pressure and expenses are running hot, the bank's Texas-focused franchise continues to execute on organic growth. The stock's muted +1.3% reaction suggests the market was largely expecting a beat given CFR's track record.

Earnings call scheduled for January 29, 2026 at 1:00 PM CT. View CFR filings